While a certificate is not a requirement to become a bookkeeper, some professionals pursue certification to show their skills to employers and stand out in their job search. Managing the general ledger is part of your daily responsibilities as a bookkeeper. You may determine if any payments are due, submit them, and record them in the financial ledger.

Bookkeeping Tools and Software

Consider taking some short bookkeeping or accounting courses to learn more. You might want to begin with Bookkeeping Basics or Intuit Bookkeeping, both offered by Intuit on Coursera. You can also learn how to use Excel to keep your books or create your business budget with Google sheets. If you’re not using software, you should consider setting a time each month to make payments and the payment method used. For example, you may have vendors you can pay online or to whom you can mail a check.

Open a Business Bank Account

Bookkeeping is one of the most important tasks that a business owner will delegate over the life of a business. Without it, it’s nearly impossible to produce an accurate gross margin vs contribution margin: what’s the difference record of financial activities that affect everything, from profit to equity to payroll, and more. When it comes to bookkeeping tasks, there’s a great deal to learn.

- Plus, with the cloud, your critical financial data is backed up safely off-site.

- Keeping up with the records in your small business might be a task you are willing and able to tackle yourself.

- Our bookkeepers here at Bench can do your books for you entirely online.

- Servers in urban areas generally earn more due to higher living costs and increased customer volume.

- QuickBooks Live Expert Assisted can help you streamline your workflow, generate reports, and answer questions related to your business along the way.

Monitor your employees’ hours with time tracking software.

Generally, if your assets are greater than your liabilities, your business is financially stable. Note that certain companies, such as those in service-based industries, may not have a lot of equity or may have negative equity. Our partners cannot pay us to guarantee favorable reviews of their products or services. Talk to your accountant to figure out if you can use off-the-shelf accounting software or if you’d benefit from customizing it. Your accountant should be able to not only offer advice but also set up the software for you and show you how to use it.

Prepare a Budget At Least Quarterly

This way, the payroll provider won’t have access to your primary account. Plus, you can ensure your payroll account has enough money even if the primary account suffers. You can get additional help with paycheck issuing, employee tax withholding, and payroll tax return filing.

A safe way to protect the cash flow is to track how long it takes for the clients to pay the invoices. Remember that assets are what your company owns, and liabilities are what it owes. A balance sheet can help you decide whether your business can meet all its financial obligations.

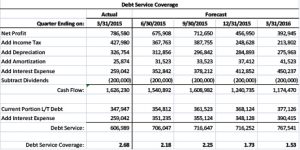

Moreover, efficient bookkeeping strategies can help you stay out of trouble with the IRS. But what if you need to come up with a down payment for an office or need to purchase new equipment and software to help you build your business? Planning for major expenses can help you best https://www.business-accounting.net/operating-expense-definition/ utilize the business credit and resources available to you while giving you peace of mind. Super pumped up about bookkeeping now and looking for something to get started on right away? Your cash flow statement helps you understand how money moves into and out of your business.

Regardless, work with your bookkeeper and accountant to ensure the amount of cash left in the bank is sufficient for unexpected costs. Finding the right level of cash to be kept on hand requires a proper cash flow forecast and cash monitoring. Businesses might not want to keep all cash in the bank, as having an excessive amount of cash in the bank could mean missed opportunities in investment income. When hiring external team members, keep in mind that some of the responsibility still falls to you as the proprietor.

However, you may reach a point where no enthusiasm or persistence level can help. Bookkeeping is often the first aspect of the business to suffer. All you have to do is scan the paper, check the details, then move on to the next one. Make sure to read online reviews, compare different pricing options, and see which features are included in the service. At the end of the accounting period, take the time to make adjustments to your entries.

In fact, it’s probably saved you a lot of money over the years. But payroll companies are surprisingly affordable and usually well worth the cost. They keep up with the latest taxes, withholding requirements, and prepping the right forms for tax season. They also help set up direct deposit and retirement plan contributions. They help you put the payment process on cruise control, so you can get a little more admin off your plate, and move on to all those other things that you do best. Let’s say you want to write off some office furniture on your taxes.

With each pay run, make sure you set aside savings to cover the payroll tax from the employee’s pay. …just because your bookkeeper may know more than you about bookkeeping, doesn’t necessarily mean it’s being done right. Below is a list of the most common tasks that are a part of the bookkeeping process. There are some free bookkeeping software programs available if you are on a tight budget. I give a break-down here of the ones that are of excellent quality and are kept up-to-date.

Paying bills and invoicing happen daily, so they can be complicated to outsource. But complex projects like reconciling your accounts and https://www.online-accounting.net/ closing the books should be done by a professional. The income statement keeps track of the cash that flows in and out of the business.

If you have too many cooks in the kitchen, sometimes things get done twice. You end up with a lot of confusion about where one person’s job ends and where the other begins. That will help clarify the expectation and create accountability. Any cash received should be paid into the business bank account or petty cash before spending it.

When you use Taxfyle, you’re guaranteed an affordable, licensed Professional. Fine dining servers can earn the highest salaries, ranging from $40,000 to $60,000 or more annually. These servers benefit from substantial tips due to higher menu prices and affluent clientele. Employers in these establishments might offer higher hourly wages and bonuses. Find out why you should get connected with a Pro to file your taxes. “ACCA-X has boosted my confidence when handling accounting tasks at work and now I’m ready to take up new responsibilities due to my proficiency.”

You don’t have to go all out and pay hundreds of dollars for this. There are many online businesses that offer logo designs at very reasonable prices (try Fiverr to start with). A business owner needs to know and recognize what type of expenses can be claimed against the profit to reduce tax, and what can’t be.